01 Introduction to Infarm

Infarm is a global vertical farming company founded in 2013 in Berlin by Osnat Michaeli and brothers Guy and Erez Galonska, who turned a 1955 Airstream trailer into the world's first mobile vertical farm. From these humble beginnings, Infarm has cultivated more than seventy categories including herbs, leafy greens, microgreens, and mushrooms, serving more than 2 million customers in 11 countries in over 1,850 shops globally, and is the fastest-growing vertical farming company in the world.Positioned at the mid-to-high end of the scale, Infarm has partnered with more than 30 major food retailers, including Metro Aldi Süd, Amazon Fresh, Auchan, Casino, E.Leclerc, Edeka, EmpireCompany Ltd (Safeway, Sobeys, ThriftyFoods), Farmdrop, Intermarché, Irma, Kaufland, Kinokuniya, Kroger, Marks & Spencer, Migros, Selfridges, Selgros, Summit and WholeFoods Market.These partners are from Canada, Denmark, France, Germany, Japan, Luxembourg, the Netherlands, the United Kingdom, the United States and Switzerland. In addition, Infarm has been launched in stores. In addition, Infarm has deployed more than 1,200 farms in shops and distribution centres, saving at least 40 million litres of water and 50,000 square metres of land. By 2025, the company plans to have 100 growing centres around the world - that's the equivalent of 1.5 million square metres of farmland and 450 million plants.

Through Infarm's advanced agricultural systems.More than 500,000 plants can be grown annually on an area of only 40 square metres, with a 95 per cent reduction in land use and a 95 per cent reduction in water requirements. To date, Infarm has saved more than 136 million litres of water, 180,000 square metres of land and almost 3 million kilometres of food,Infarm is the first vertical agriculture company committed to setting science-based net-zero carbon targets through the Science Based Targets programme. Over the years, Infarm has revolutionised the food supply chain with its mission to ‘make cities self-sufficient in food production while improving food and environmental quality’.It has developed a planting box to help convenience stores grow spices and vegetables through an indoor vertical farm system. It has developed a planting box to help convenience stores grow spices and vegetables through an ‘indoor vertical farm system’, which includes a light source and thermostatic equipment so that planting is not constrained by seasonal changes, thus helping cities to achieve self-sufficiency in food production.

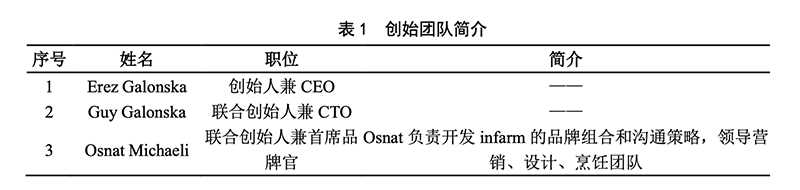

Infarm Founding Team

Infarm was founded in Berlin in 2013 by two Israeli brothers, Erez Galonska and Guy Galonska, and Erez's girlfriend, Osnat Michaeli, with the aim of building a global network of extremely climate-resilient vertical farms through modular vertical farming units and IoT technology. The positions and responsibilities of the three founders are as follows.

Infarm's funding history

In August 2015, Infarm closed a seed round with exclusive participation from European-Pioneers.

In November 2016, Infarm received a €1.9 million donation from the EASME-EU Executive Agency for SMEs.

In April 2017, prior to the seed round, Infarm received an exclusive €400,000 investment from Archimedes Labs.

In June 2017, Infarm received €4 million in seed funding led by Cherry Ventures and followed by LocalGlobe, AtlanticFoodLabs, Quadia and IDEO. Upon completion of the financing, Infarm's company market capitalisation was valued at roughly RMB 130 million.

In February 2018, Infarm received an exclusive €2 million donation from Horizon 2020.

In February 2018, in a Series A round, Infarm received $25 million in funding led by Balderton Capital and followed by LocalGlobe, CherryVentures, Quadia, TriplePoint Capital and others. After the completion of the financing, Infarm's company market capitalisation was valued at roughly RMB 813 million.

In July 2019, in a Series B funding round, Infarm received $100M led by Atomico and followed by Balderton Capital., CherryVentures, Astanor Ventures, TriplePoint Capital and others. After the financing was completed, Infarm's company market capitalisation was valued at roughly RMB 3.25 billion.

In September 2020, in Series C funding, Infarm received $170 million led by Lightrock and followed by Atomico, Bonnier Ventures, Hanaco Venture Capital, TriplePoint Capital, Lightrock and others.

In March 2021, in a Series C+ funding round, Infarm received $100 million in investment capital from Atomico and Hanaco Venture Capital.

In January 2022, in a Series D round, Infarm received $200 million in financing led by Qatar Investment Authority (QIA) and followed by Partners in Equity, Hanaco Venture Capital, Atomico, Lightrock and Bonnier Ventures. Ventures, led by Partners in Equity, Hanaco Venture Capital, Atomico, Lightrock and Bonnier. The funding will be used primarily for Infarm's international expansion plans, which include existing markets in the U.S., Canada, Japan and Europe, as well as new markets in Asia Pacific and the Middle East, where the Qatar Investment Authority will support the company's expansion in the region. To date, Infarm has raised over $600 million in total funding and is valued at $1 billion, making it the first unicorn company in the European agriculture vertical.

02 Target Markets - Europe and the United States

Production Side: Digital Enablement + Agricultural Talent Training

Europe and the United States as developed countries, has basically completed the construction of modernisation, basic industry, high-tech and other engineering industries are quite developed, so these countries put a lot of money into agriculture, in the support of industrial modernisation, it is easier to achieve agricultural machinery, digitalisation, high-tech agriculture, reduce the cost of loss, and greatly improve the profitability of agriculture; coupled with Europe and the United States itself has been developed for many years, the state More affluent, the people are now more than just the pursuit of ordinary material pursuits, more is a high quality of life, agriculture accounts for a large proportion of daily life, so vigorously develop agriculture can promote the domestic economic cycle, greatly improving the country's economic strength.

There are two main modes of agricultural modernisation in Europe and the United States: the large-scale, mechanised, high-technology mode represented by the United States and the composite mode of production intensification plus mechanical technology represented by Europe. Nowadays, both models have embarked on the path of digitally empowered agricultural modernisation process. For example, with the application of computer technology and biotechnology, the United States has seen the emergence of ‘precision agriculture’ and ‘genetic agriculture’. In particular, many mega-farms towards the ‘computer integrated adaptive production’, that is, market information, production parameter information, capital, labour information, etc., integrated together, selected the best planting plan, in the growth process according to the changes in the local microclimate of different plots of land, adaptive water spraying, fertilizer, sprinkle medicine, etc., the agricultural production is more inclined to Factory, automation, so that the level of modernisation of U.S. agriculture continues to improve, always at the forefront of the world; at present, Germany is committed to the development of a higher level of digital agriculture. Through the application of big data and cloud technology, a field of weather, soil, precipitation, temperature, geographic location and other data uploaded to the cloud, the cloud platform for processing, and then send the processed data to the intelligent large-scale agricultural machinery, commanding it to carry out fine operations.

Europe and the United States also have a lot in common in the training of agricultural personnel: farmers are a profession, people can choose according to their own wishes and ideas, but this choice is a two-way street, not only the practitioner chooses the farmer's profession, but also the profession for the practitioner's screening.The professional farmers are highly qualified, not only have the knowledge of popular crop cultivation or fishery and animal husbandry, but also have intelligent, modern and scientific skills; in addition to agricultural knowledge, they also have mastered the operation and sales skills, the application of management models and innovation, and other excellent modern scientific qualities.In addition, countries have introduced a series of policies to support the development of agricultural talent. In addition, the State has introduced a series of policies to support the development of agricultural talent; for example, Germany has set up a network of agricultural entrepreneurship centres to promote agricultural entrepreneurship among young people.

Mode of supply: a relatively large share of sales by supermarkets

In Europe and the United States agricultural supply model, the main operating body is a large supermarket, retail chain enterprises, and the establishment of a set of production, processing, packaging, warehousing, logistics, sales integration of agricultural products industry system, for the majority of farmers to provide one-stop services for agricultural products.

In addition, the wholesale market of agricultural products in Western Europe, the main use of the auction trading model, a true reflection of the market supply and demand, and improve the efficiency of agricultural transactions; Western Europe's agricultural cooperatives in the circulation of agricultural products play an important role in the process; the market has a perfect standardisation system of agricultural products. Under the North American agricultural supply model, the wholesale market for agricultural products is highly concentrated, with wholesalers and retailers accounting for a high proportion of the transaction volume; the circulation cycle is short and highly efficient.

The marketing market for organic food in Europe is relatively well developed, and in most countries there are four marketing channels for organic food: general supermarkets, specialised organic food shops, direct sales and other sales.. Of these types of sales channels, theDirect marketing by farmers accounts for 25 per cent of the organic food market shareThe traditional sales model of counters and zones accounted for 25 per cent of the market share.Organic shops account for 50 per cent of the market.This type of marketing is also a high degree of professionalism. This boutique-style marketing approach also demonstrates a high degree of professionalism in sales, which is mainly achieved through large and medium-sized organic food wholesale distribution centres to achieve a smooth flow of organic food goods across the country.

There are three major sales channels for organic food in the United States, namely, natural food shops, conventional supermarkets and direct sales markets for agricultural products. According to the statistics of the Organic Trade AssociationMost organic food is sold through natural food shops, followed by conventional supermarkets, which account for 49 per cent of sales in the United States, exceeding the share of natural food shops (48 per cent), and direct markets, which account for only 3 per cent of sales. Now many large supermarkets in the United States have counters specialising in natural and organic foods, such as Whole Foods Supermarket (Whole FoodSupermarket), the health food shop in Queens, New York City, there are counters specialising in the sale of organic vegetables.

In general, the main sales channels for organic food in Europe and the United States are shops and supermarkets.

In general, the main sales channels for organic food in Europe and the United States are shops and supermarkets.

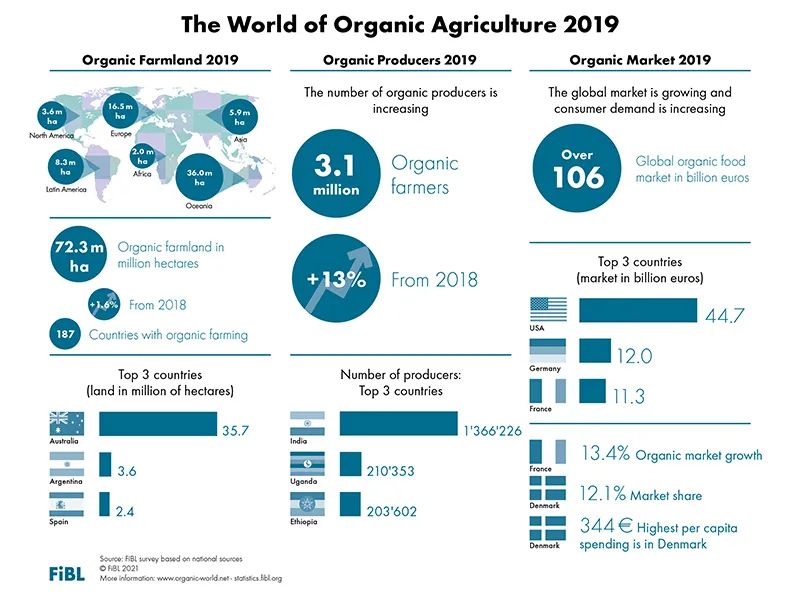

According to a survey conducted by the Swiss Institute of Organic Agriculture (FiBL) and the International Federation of Organic Agriculture (IFOAM), 71.5 million hectares of farmland were managed organically worldwide in 2018 (including land in conversion). The two continents with the largest areas of organic farmland are Oceania (36 million hectares, about half of the world's organic farmland) and Europe (15.6 million hectares, 22 per cent). Geographically, the two continents with the highest share of organic farmland in total agricultural land were Oceania (8.6 per cent) and Europe (3.1 per cent, with 7.7 per cent organic farmland in the EU.) In 2018, the global area of organic farmland increased by 2.0 million hectares, a growth rate of 2.9 per cent. Many countries experienced significant growth in organic farmland, such as France (up 16.7 per cent to over 270,000 hectares). Organic farmland increased on all continents, for example in Europe by almost 1.25 million hectares (up 8.7 per cent).The area of organic farmland in Asia increased by 540,000 hectares, or nearly 8.9 per centThe area of organic farmland in North America increased by nearly 100,000 hectares, or more than 3.5 per cent.

Sales of organic food and beverages exceeded €95bn in 2018. In 2018, the largest markets for organic products were the United States (€40.6bn), Germany (€10.9bn) and France (€9.1bn).The countries with the highest per capita consumption of organic food globally in 2018 were Switzerland and Denmark, with €312. The countries with the highest organic market share were Denmark (11.5 per cent), Switzerland (9.9 per cent) and Sweden (9.6 per cent), with Denmark also being the first country to have an organic market share of more than 10 per cent. By the end of 2019, 50 per cent of the world's organic produce market is in Europe and North America. World sales of organic agricultural products totalled €106.4 billion, with the United States leading the way with €44.7 billion, followed by Germany (€12.0 billion), France (€13.3 billion).China ranked fourth in the world with €8.9 billion.

The Global Organic Industry 2020 white paper indicates that the global organic farmland area reached 74.9 million hectares, an increase of 4.1 per cent compared to 2019; approximately 3.4 million people worldwide are engaged in organic farming, an increase of 7.6 per cent compared to 2019; and the global organic market sales reached US$136.8 billion (€120.6 billion), with the United States, Germany and France continuing to lead the global organic consumer market with US$56.5 billion, US$17.0 billion and US$14.6 billion, respectively. The United States, Germany and France continue to lead the global organic consumer market with $56.5 billion, $17.0 billion and $14.6 billion respectively.

总的来说,全球有机农地面积和有机食品销售总额逐年增加,美国、德国、法国有机市场份额稳居前三。据调查,73%的法国人和 60%的丹麦人经常购买有机蔬菜,56%的美国公民认为有机食品更为健康。在美国,超市里 75%供应的都是有机产品,91%的沃尔玛顾客会选择有机产品,而 70%的 Target 的顾客也会选购有机产品。美国人愿意买有机蔬菜的原因首先是健康与营养:有机蔬菜的营养成分较高;其次是支持环境保护和生态平衡;再者有机蔬菜的口味好,芳香物质和可食用纤维素多。消费者对高质量的有机食品的需求将稳步增长,特别是市场份额较高的有机食品如蔬菜和水果、婴幼儿食品、粮食类、奶制品等。

03 Staged Operating Model Analysis

Pre-operation mode:Live broadcast, exhibition to expand awareness and raise funds

Founded in 2013 in Berlin by Osnat Michaeli and brothers Guy and Erez Galonska, Infarm was in its infancy in 2013-2014 and the team was still worried about funding and equipment. Attracting funding streams to create a business and make it viable was a major challenge for the founding team.

On 8 May 2014, they opened a live stream for fundraising from their vertical farm inside the Airstream trailer they built and managed to raise €27,858 as part of their dream start-up fund. And after thatThey sell the greenery they grow while travelling to exhibitions and organisations to raise their profile.. From the street to the showroom, their creativity and ideas have gained considerable recognition and support. The reason for this is that in Europe and the United States, after the large-scale environmental protection movement that began at the end of the 20th century, awareness of environmental protection has generally increased, and the public has become more and more aware of the chain reaction that occurs with nature in their lives. For example, in the early 1980s, a citizen-driven green movement sprang up in Western countries. On the basis of this broad mass movement, the Green Party, a green political organisation, was created in the 1980s in various European countries, with Germany being the first place where the Green Party was born. In the same year, Infarm developed its first product ‘Microgarden’, a small origami greenhouse for growing miniature greenery at home, together with the Swedish design company Tomorrow Machine, which was successfully launched through a crowdfunding campaign. In addition to this, Infarm has developed a growing system for the 25h Bikini Hotel.

In August 2015, Infarm secured a solo round of funding from EUPioneers, which they used to set up an in-store farm and build a vertical farming base, and in October, the first in-store farm in Europe was opened, which was a bold move for Infarm, as from the outset they had favoured supermarkets as an entry point to open up the market. From now on, this first in-store farm has been a great promotional tool for Infarm. Even in mid-development, they have been attracting customers' attention with offers and a series of events, and Erez Galonska revealed in an interview in 2015 that they have beenActively participated in organic marketing exhibitions around the world and also presented the concept of vertical farming at the OlympusPerspectivePlayground at the Palais de Tokyo in Paris, introducing the benefits and future prospects of the concept to the public.In November 2015, the Tidal Irrigation System Vertical Farm was installed and they have been growing rapidly ever since. The business focuses on selling vegetables from growing cabinets, a partially profitable in-store farm and a customised system model.

During 2014-2015 Infarm built customised growth systems for high-end clients such as Mercedes Benz, 25h Hotels, Airbnb and many more. It's worth noting that at their headquarters in Kreuzberg, workshops and culinary events are often organised where people can learn and experience cooking. And the raw materials are none other than the vertically farmed vegetables they provide with theirThe range of equipment (including planting cabinets) is also on display, which creates a great deal of interest and leads to better publicity through cookery sharing sessionsThe Vertical Farm is a new venture in the world of green farming. They have been learning to absorb the relevant technical know-how talents and have been marketing the grown greenery and their concept of vertical farms as a technology before they formally stepped into the wider market. And withPeople are becoming more environmentally conscious, and the advantages of using less, being healthier and more convenient have become a major advantage for Infarm..

Medium-term operation mode: aiming at TO B, seeking long-term partners

Within two years of introducing the concept of indoor farms, Infarm operates more than 50 farms in supermarket aisles, restaurant kitchens, and distribution warehouses in Berlin, Germany, such as EDEKA, Metro, and celebrity chef Tim Raue, selling affordable vegetables.

Between February and March 2016Infarm and Metro have entered into a partnership where Infarm's Metro Vertical Farm Crops are on sale, attracting a large number of customers.At first they simply recommended their own grow cabinet products and freshness to Metro, and made a profit by growing and selling vegetables in supermarkets with relatively high concentrations of population, or even through home cabinets. Therefore they grew herbs and speciality vegetables such as watercress and mustard in their pilot units. However, due to strong interest from restaurants and speciality grocers, they started to adopt a business-to-business model (Big B). They partnered with design firm Ideo to create this business model.Companies like Metro will buy vertical farming units at a lower price and then buy software that helps automate the management of the units - so simple that any supermarket employee can handle it with an app.

Infarm's founder said in an interview.‘We call this farming a service.’ ‘It's similar to the software world - or similar to the razor blade model - where we sell the technology at a relatively low price and then provide all the supplies and extras, like software."

The Metro pilot lasted almost 1 year. By the end of 2016, Infarm plans to begin mass production.

In April 2016, Infarm joined the European Commission's Startup Europe programme, a startup acceleration service created by the European Commission to encourage developers of advanced technologies, which provides advice and links to resources for entrepreneurs, and provides companies with corresponding startup resources and opportunities. This was a welcome relief for Infarm, which was already planning to go international. Through this platform, Infarm was able to recruit talent from all over the world to further increase the size and reach of the team.Infarm remains committed to its programme of entering supermarkets as a profitable vegetable supplier, setting up multiple in-store farms and vertical farm bases to grow herbs, greens, etc.. It has also not stopped exploring the cultivation of other plants, representative of which are peppers, tomatoes and other micro-vegetables.

By this time, Infarm had gained a significant market presence in Germany and was exploring the cultivation of other plants, such as mint, in other countries, looking for long term partners. Infarm's influence was also growing, and their achievements in the field of vertical farming, or the impact of their results on the environmental movement, earned them a nomination at the Energy For Tomorrow conference in November. In November, Infarm was nominated for the Energy For Tomorrow conference and in November, Infarm received a €1.9 million donation from EASME - EU Executive Agency for SMEs.

Infarm has been actively looking for long-term partners throughout 2016-2017, with many of the major food retailers working on a similar model to Metro, where Infarm sells the technology and additionally provides the supply and services. Take, for example, Marks & Spencer's London Marks & Spencer food shops, which are owned by the UK-based department store Marks & Spencer.

People walking into the Marks & Spencer Clapham Junction shop will see three different varieties of basil growing in the shop as well as mountain coriander, mint and parsley.However, the picking is done by Infarm staff, who visit the shops twice a week to do the picking, retaining the roots to maintain flavour and freshness. At the same time, infarm has set up a distribution centre in London to supply the seedlings, which are then delivered to shops.

In 2017, Infarm began to envision expanding its international presence by establishing a vertical farm in Japan and entering the Japanese market. in February, Infarm held a press conference to promote the concept of vertical farming and its benefits to a wider audience through the media, and at the same time revealed its intention to collaborate with major distributors and retailers in the food market. In the same month, Infarm became the first vertical farming company in the world to be certified by globalgap (Global Good Agricultural Practices), a certification that translates consumer demand for agricultural products into farming and is rapidly becoming recognised in many countries. Infarm's globalgap certification has greatly increased its brand credibility and international presence, and has also led to partnerships with major food retailers, creating conditions for new profit models. in June, Infarm received €4 million in funding led by cherrvy Ventures, with follow-on investments from Atlaantic Food Labs, Quadia and IDEO.

April of the same year.The first vertical farm restaurant (restaurant + farm model), operated and managed by Infarm, opens in Berlin and quickly generates significant revenues, and Infarm begins actively exploring farm restaurant partners.

Later Operation Mode: Going Global and Expanding Product Diversity

After 2018, Infarm is actively developing cash crops such as mushrooms, speciality fruits and vegetables, and in February Infarm secured $25 million in Series A funding. As of the Series A round, Infarm has raised $35 million, including a €2 million grant from the European Commission, and after the funding is complete, Infarm plans to expand nationally, such as in Paris, London, Copenhagen, and more. Our ultimate goal is to expand to places like Seattle in the US and Seoul in South Korea,’ says Erez Galonska, the company's co-founder and CEO. At this point in time, Infarm's team consists of more than 100 talented individuals in the fields of horticultural management, architecture, industrial design, marketing, machine learning, and more. The new funding will help the company further expand its team and expand its R&D centre in Berlin. The R&D centre is dedicated to promoting biodiversity and expanding the company's product portfolio.

Infarm's indoor farms are harvested every fortnight, with a monthly yield of 1,200 plants from a single farm (2 square metres), and some of its operations are already fully self-sustaining.Infarm combines highly efficient vertical farms with IoT technology and data science to connect and control indoor farms in various locations through a central farm platform, creating a network of urban farms. According to Infarm co-founder and CTO Guy Galonska, the company collects 50,000 data points on each plant as it grows, and each farm acts as a data pipeline, relaying information about plant growth collected by multiple sensors to a platform that works around the clock to learn, adapt and optimise in real time.This model ensures that Infarm can tailor its farms to each customer's unique needs, cultivating different types of plants or adapting the flavour of the crops to better suit the customer's tastes, eliminating the need for lengthy shipments and delivering fresh fruits and vegetables in a timely manner..

As of 2019, Infarm has more than 500 farms set up in shops and distribution centres in Germany, Switzerland, France, Luxembourg and the UK. Overseas markets to be explored are still considerable and Infarm is actively expanding its business partnerships. In 2020, a deeper co-operation with Italy will strengthen the relationship between the company itself and its partners, thus fulfilling the goal of entering the international market.

In June 2019, infarm secured another $100 million in Series B funding and has already partnered with several European food retailers, including Intermarche, Migros, and Amazon Fresh. and Marks & Spencer is the first UK retailer infarm has partnered with. Infarm's partnership with them is set to expand further due to the high-yield, low-consumption, stable and environmentally friendly nature of vertical urban farms, which Marks & Spencer has also said it will introduce to a further six of its London shops. In fact, it's not just department stores that are introducing vertical farms, but also many restaurants and hotels.

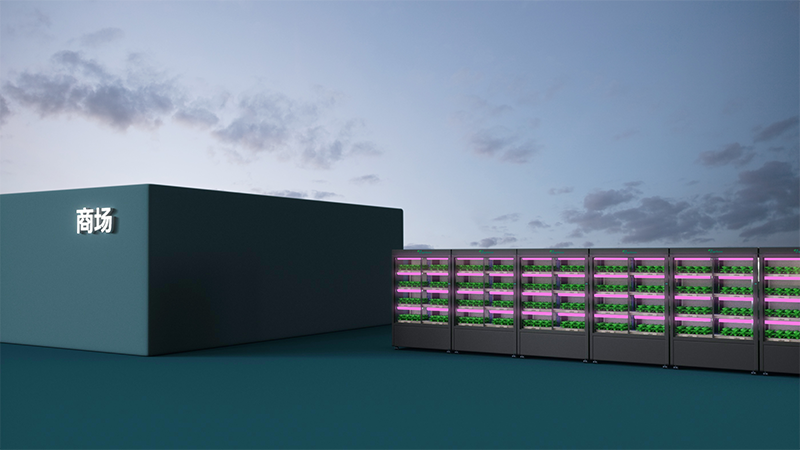

Thanks to Infarm's modular design - one ‘module’ usually occupies one layer, and each layer can be planted with different plants. Thus, the user's freedom of combination is realised.Infarm can serve a wide range of scenarios, not just limited to shops and restaurants, but also small micro-growing modules set up within the city to supply urban communities.On-site production on-site sales is the biggest feature of this model, reducing the cost of logistics and distribution links and waste, almost can be done at the same time as the sale of fruits and vegetables picking also makes fruits and vegetables to be fresher, so suitable for the freshness requirements of the higher demand for consumer needs!Infarm therefore works directly with local supermarket chains. Depending on the size of the demand for varieties in the regional market, one or more planting sites are selected. infarm therefore works directly with local retail supermarket chains.The in-store farming module is set up in the shop to form an in-store farm, where consumers in the neighbourhoods covered by the supermarkets pick and sell their food when they come into the shop to buy it.

Currently, InFarm works with 25 major food retailers such as Edeka, Metro, Migros, Casino, Intermarche, Auchan, Selgros and Amazon fresh, with close to 300 farms installed in 150 shops in Germany, Switzerland and France, producing around 500,000 plants. The company's products are

04 The Infarm Way to Success

Trinity solves agricultural problems, feeds the world

Agriculture is a huge industry, and as the global population grows, the issue of food supply looms large. At the same time, with 17 per cent of global CO2 emissions coming from the food production sector, current farming practices seem unsustainable. However, this is changing as humanity explores innovative vertical farming strategies, and vertical farming startups like Infarm are attempting to revolutionise the industry.

Infarm is a Berlin-based vertical farming startup that aims to disrupt agriculture with vertical farming technology. There are currently over 40 such companies around the world exploring ways to bring indoor farming as an alternative to traditional farming methods. Among them, Infarm has been expanding its vertical farming operations significantly and holds a significant position globally. Therefore, Infarm and its vertical farming operations deserve a closer look.

Infarm CEO and co-founder Erez Galonska said: ‘Infarm was founded with a grand vision to meet the needs of tomorrow's cities by bringing farms closer to consumers, and Infarm's financing is aimed at further expanding the business.

Infarm, a vertical agriculture startup, was founded in 2013 by Osnat Michaeli, Erez Galonska and GuyGalonska. Although the company is relatively young, its impact cannot be underestimated. It currently has over 200 farms in-store and 150 farms in distribution centres, harvesting over 150,000 plants per month. Its vertical farming model has been developed in France, Switzerland and Germany, while it will expand to the UK this autumn.

What is Infarm's approach to vertical farming? Infarm offers stand-alone modules for growing herbs, lettuce, fruits and various vegetables. But instead of putting them on farmland, Infarm puts them in restaurants, grocery shops and even schools, so customers can ‘harvest’ their produce directly. This revolutionary concept, and the technology behind it, is why Infarm has received more than $134 million in funding.

Vertical farming innovations are sustainable, energy efficient and environmentally friendly

Infarm's vertical farming modules are not just displayed in restaurants or grocery shops. It connects all these modules to Infarm's central control centre via the cloud. From the command centre, each patch's plant nutrition, light and water usage is monitored to ensure optimal conditions. What's more, Infarm uses data analytics and IoT big data to continually advance its operations. Essentially, the company is changing the process of traditional farming through the use of these technologies. In other words.Infarm's Farming-as-a-Service platform puts farms directly in front of customers to deliver fresh, organic, high-quality food.

Bypassing the farm and using an ‘agriculture-as-a-service’ platform offers many other advantages in addition to customer engagement. Compared to traditional farms, it has been reported thatInfarm uses 95 per cent less water and 75 per cent less fertilizer. Similarly, its methods eliminate 90 per cent of the transport burden of bringing food to its destination. This is important because almost one-and-a-half of all agricultural nutrients are lost during transport. Finally, Infarm does not use any pesticides at all. Clearly, this vertical farming solution offers a more sustainable alternative to traditional agriculture.

Even though Infarm is a relatively young vertical agriculture startup, it's pushing the boundaries of an entire industry. Infarm recently secured another $100 million in venture capital and debt financing. This funding will help Infarm expand its reach into the UK, US, Asia and the rest of Europe. As a result, the startup has increased its original plan to grow 50 vertical farming regions per quarter to 350 per quarter.Infarm believes that through its big data learning analytics, along with key partners, it can expand its business without sacrificing quality.

With its ‘plug and play’ modules, Infarm makes it easy for organisations to implement vertical farming systems. Space constraints aside, businesses will be attracted not only by the ability to cut food transport costs, but also by the ability to deliver better quality products at an affordable price. Considering all of this and the huge sustainability benefits, vertical farming could ultimately be very disruptive to agriculture. And because of companies like Infarm that are applying ‘farming as a service’ innovations, that disruption is coming.

Data-enabled, accurate matching between supply and demand

Infarm has set up indoor ‘micro-growing modules to supply urban communities’ to produce and sell locally. Using this model, Infarm has chosen to set up one or more sites depending on the size of the demand for cultivars in different regional markets.Working directly with local retail supermarket chains, in-store farming modules are set up to create ‘in-store farming’, where consumers in the supermarket's catchment neighbourhoods pick and sell their produce as they enter the shop to buy. Multiple innovative distributed farms are connected through a centralised agricultural platform to form an urban farming network. Each growing module, through infarm's cloud-based control centre, forms a controlled ecosystem that can be tailored to conditions such as light, temperature, pH and nutrients to ensure the optimal growth of each plant. The variety and quantity of plants selected for each module can be set and adjusted according to the consumption data of the local community, maximising demand and minimising waste.This is why capital is so interested in Infarm's pioneering business model. This is the reason why the capital showed strong interest in Infarm's pioneering business model. infarm owns the whole set of technology, is responsible for the complete production process, and also has direct access to the sales side of the consumer purchasing behaviour data, from the production to the sales side of the data can be said to be under the direct control of infarm, can be easily matched to adjust.

It is difficult to control the consumer terminal with the model of ‘supplying many neighbouring cities with mega plantation factories in rural areas’ and ‘supplying local demand with large plantation factories in the suburbs of cities’, represented by Plenty. In the field of agricultural production, a good harvest does not necessarily mean an increase in income, and the best state is only when the output can accurately match the demand.

05 Prospects for Vertical Farming in China

market environment

Production side: poor mechanisation base + scarce total agricultural talents

First of all, China's arable land covers an area of about 1.825 billion mu, with a per capita arable land area of about 1.36 mu, which is only about 14 per cent of that of the United States, and the per capita agricultural labour force in China is only about 10 mu, which is about 1 per cent of that of the United States. And China's vast area, hills, mountains, plateau area accounted for about 69% of the total land area, about one-third of the country's agricultural population and arable land in the mountains, compared to the United States, China's agricultural production conditions are far away, not conducive to the development and popularity of agricultural mechanisation.

Secondly, there are many kinds of crops in China, and the planting systems and cultivation modes of various crops are different and complex. Different kinds of crops agronomic requirements are not the same, in mechanised farming, sowing, harvesting, post-production treatment and other aspects of the agronomic process varies greatly, requiring different types of agricultural machinery to complete, these are on the adaptability of agricultural machinery to put forward more, higher requirements, affecting the rapid popularity of agricultural mechanisation.

Once again, China's hilly and mountainous areas, small parcels of land, complex terrain, is not conducive to the development of agricultural mechanisation; China's farmland infrastructure, irrigation facilities, farm roads and other infrastructure is relatively poor, a lot of farmland there is agricultural machinery can not go down to the field, can not get to the ground, the implementation of the problem of not open. At present, the land unsuitable for agricultural machinery operations for the transformation of machinery has become hilly and mountainous areas of agricultural mechanisation level, accelerate the transformation and upgrading of agricultural mechanisation of effective measures.

The overall cultural quality of China's agricultural workers is relatively low. Most of the young people go to the city to work, the rest of the agricultural production in the countryside is mostly older, lower cultural quality of the labour force, is not conducive to the promotion and application of new agricultural machinery technology, new agricultural machinery. At the same time, farmers‘ income level is relatively low, and the one-time investment in large agricultural machinery is large, with high operating and maintenance costs, which affects farmers’ investment in agricultural machinery.

Relative to the United States, the development background and basic basic conditions of agricultural mechanisation in China are relatively poor, which is a basic national condition that cannot be surpassed and must be considered, and it is more difficult and heavier for China to achieve comprehensive full-scale agricultural mechanisation. In recent years, with the vigorous promotion of national agricultural machinery subsidies, the level of agricultural mechanisation in China has increased significantly, by the end of 2019, the total power of China's agricultural machinery reached 1.004 billion kW, and the degree of comprehensive mechanisation of the national agricultural plantation industry reached 69%, with the level of mechanisation of ploughing reaching 84%, the level of mechanisation of sowing reaching 56%, and the level of harvesting mechanisation reaching 61%, of which the three major staple grains, namely, wheat, rice, and maize, had a level of comprehensive mechanisation of crop production respectively. Among them, the mechanisation levels of the three major staple crops, namely wheat, rice and corn, have reached 95 per cent, 81 per cent and 88 per cent respectively.

For the cultivation of high-quality farmers, the Circular of the General Office of the Ministry of Agriculture and Rural Affairs on the Cultivation of High-quality Farmers in 2021 instructs that it is necessary to focus on key tasks, give full play to the role of the education and training system for farmers, integrate and make use of high-quality education and training resources, carry out training for the whole industrial chain in a hierarchical and classified manner, enhance the quality and benefit of education and training, strengthen demonstration and promotion of cultivation achievements, and develop and expand the team of high-quality farmers. The Government of the People's Republic of China

Mode of supply: wholesale markets for agricultural products account for a relatively large share of transactions

At present, China's agricultural product circulation market has formed a pattern in which farmers, farmers‘ cooperatives, agricultural product processing enterprises and distributors are the main circulating bodies, with farmers’ markets and wholesale markets as the carriers. This is after many years of market-oriented changes from the planned regulation of the unified purchase and marketing model evolved. Here we will analyse the four patterns that exist in China at this stage.

1) Farmers + (buying hawkers) + wholesalers + retail terminals

The model can be divided into two forms: the existence of hawkers, in China's vast rural areas, farmers will be harvested after the agricultural products are sold directly to the vendors, and these vendors will be directly purchased by the agricultural products resold to the next level of wholesalers, wholesalers and then resold to retailers, the end of the circulation of agricultural products; the absence of hawkers, the prerequisites of this model is that a certain kind of agricultural products are concentrated large-scale planting in a certain area, the formation of large-scale Economy, farmers can enter the market at a lower cost and wholesalers to trade directly.

2) Farmers + leading enterprises + (wholesalers) + retail terminals

The key to this distribution model is the relationship between farmers and leading enterprises. According to the contract signed by both parties, farmers produce a certain amount and type of agricultural products according to the corresponding product quality standards in the contract, while the leading enterprises are both purchasing, processing and marketing the purchased agricultural products for further processing to improve the added value of agricultural products, and then resell them to the lower level of wholesalers and retailers to complete the circulation, this kind of circulation operation is known as the ‘order farming This kind of distribution operation is called ‘order agriculture’.

3) Farmers + farmers' co-operatives + leading enterprises + (wholesalers) + retail terminals

Under this model, farmers and dragon-head enterprises are no longer directly linked, and farmers' cooperatives become the link and bridge between the two. The co-operatives concentrate the scattered farmers, organise production according to the order requirements, make unified purchases of the farmers' products, and then organise sales in a unified manner.

4) Farmers (agricultural co-operatives) + retail terminals (supermarkets)

This kind of circulation is called ‘agricultural super docking’, supermarkets participate in the production, processing and circulation of agricultural products by virtue of their own capital, management, technology and other aspects of the advantages of the production and processing process, and its information, technology, logistics and other aspects of the provision of one-stop services for agriculture, so that farmers and the market without the need for circulation organisations can be effectively connected to achieve the reduction of circulation links, reduce the cost of circulation purposes. The purpose is to reduce the circulation links and lower the cost of circulation.

Although the channels and modes of circulation of agricultural products are constantly being developed and improved, the following points are still the current situation affecting the efficiency of the circulation of agricultural products, which cannot be ignored.

Firstly, ultra-small-scale farmers and individual households are still the most important main body of the circulation of agricultural products in China. Compared with developed countries, the main body of production and circulation of agricultural products in China are mainly farmers and individual households engaged in wholesale and retail of agricultural products. Agricultural enterprises are very few, and the scale of operation is small. Among them, the average household operates 7.94 mu of arable land. The average household sells 1,047.34 kilograms of grain, 97.62 kilograms of pork and 55.48 kilograms of eggs, which is a relatively small-scale type of agricultural production in the world, but small-scale agricultural production will inevitably have a great impact on the efficiency of distribution.

Secondly, there are a large number of wholesale markets for agricultural products, but the average transaction size is small, the grade is not high and the function is not perfect. Starting in 1991, China began to treat the establishment of a market system for agricultural products centred on wholesale markets as an important element of circulation reform, and to set up a network of interconnected and mutually supportive central and regional wholesale markets for agricultural products in concentrated production areas, distribution centres and large and medium-sized cities. By 2007, the total volume of transactions in agricultural product wholesale markets of more than 100 million yuan in China was approximately RMB 930 billion, accounting for 37 per cent of the gross agricultural product. The proportion of agricultural products traded through wholesale agricultural product markets nationwide is as high as over 70 per cent, and this proportion continues to rise.

Thirdly, the technological content of the channel is generally low, which leads to low efficiency. Agricultural products transport channels, such as the use of freshness, preservation, anti-corrosion, loss prevention of the high technology required, is a very important technology in the channel of agricultural products, agricultural products, high water content, short shelf life, very easy to rot and deterioration of the characteristics of the channel of the transaction time and preservation of freshness put forward a very high demand, and China's current channel construction and the level of technology are yet to be improved.

Since 1999, the domestic market for organic products has also been developing rapidly, with the main sales channels being hypermarkets, specialised organic food shops, direct sales, wholesale and group sales, with large retailers holding a dominant position in the market. According to the survey, the price of organic products is generally high, and the research report of the China-EU Trade Project (Eu-China Trade Project) points out that: the price of green vegetables is 30 per cent higher than that of ordinary vegetables, and the price of vegetables such as asparagus can be doubled.Prices of organic vegetables sold in supermarkets in Shanghai and Beijing are generally two to four times higher than those of ordinary vegetables, and up to ten times higher.A survey of the Nanjing market found that the price of organic vegetables sold in a speciality shop in Nanjing was 50 to 150 per cent higher than that of conventional vegetables in the neighbourhood, with an average of 100 per cent higher. The high price premium for organic agricultural products indicates that the development of China's organic agricultural products market is still in its infancy.

Consumer side: low demand for green and organic food but high potential for growth

Vegetables, as an indispensable food for the daily life of China's residents, have been developing rapidly in the vegetable industry with the reform of the vegetable production and marketing system, the adjustment of the planting structure and the increasing concern for food safety in recent years, and the production and sales volume have been increasing accordingly.

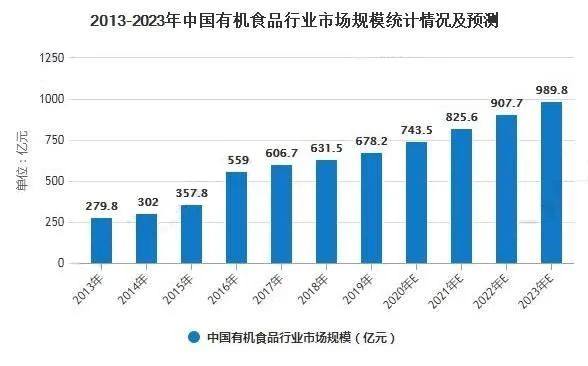

China's vegetable consumption has maintained a steady growth trend in recent years. National vegetable consumption increased from 681 million tonnes in 2017 to 724 million tonnes in 2020, with a compound annual growth rate of 2.26%. China Business Industry Research Institute predicts that China's vegetable consumption will reach 752 million tonnes in 2022. (Data source: Ministry of Agriculture and Rural Development, China Business Industry Research Institute) China Report Hall Network, 2022 China's organic vegetable purchasing habits have not yet been formed. China's agricultural planting structure is constantly adjusted, and the sown area of vegetables shows a rapid growth trend.According to the International Organic Federation, the domestic sales of organic products in China in 2019 totalled RMB 67.82 billion, up RMB 4.672 billion year-on-year, and the sales of organic food processing products amounted to RMB 63.37 billion, up RMB 6.44 billion year-on-year; at the same time, the exports of China's organic products in 2019 have reached a total of US$730 million, an increase of 81% year-on-year. The 2022-2027 China Organic Vegetables and Fruits Industry Key Enterprises Development Analysis and Investment Prospect Feasibility Assessment Report points out that the number of organic vegetables and fruits increased from 19981.07 thousand hectares in 2017 to 21872.21 thousand hectares in 2021, with a CAGR of 2.3%. With the 14th Five-Year Plan encouraging and supporting the agricultural products industry, the sown area of vegetables in China can reach 22,356.35 thousand hectares in 2022.

According to recent statistics from the Swiss Institute of Organic Agriculture (FiBL) and the International Federation of Organic Associations (IFOAM), China has become the world's fourth-largest organic market and the seventh-largest country in terms of the area of organic farmland.. According to the latest statistics published by the above two organisations, by the end of 2019, the world's total sales of organic agricultural products amounted to 106.4 billion euros, with the United States taking the lead with 44.7 billion euros, followed by Germany (12.0 billion euros), France (13.3 billion euros), and China ranked the fourth in the world with 8.9 billion euros; while the global land used for organic agriculture amounted to 72.3 million hectares by the end of 2019, with Australia is the country with the most organic farmland (35.69 million hectares), followed by Argentina (3.67 million hectares) and Spain (2.35 million hectares), and China ranks seventh in the world with 2.22 million hectares. It should be emphasised that, according to the report, China has shown explosive growth in both areas.

In the short span of ten years, with the expansion of China's middle class consumer groups and the improvement of the quality of organic agricultural products and processed foods, China's organic agricultural products and processed foods have prospered, and in the next five years, China is expected to become the world's strongest country in organic agricultural products and food processing. Three reasons are as follows.

First, with the Chinese government placing the fight against climate change in a more prominent position in national governance, a universal green transformation that promotes economic and social development is taking place on a large scale. While promoting a green and low-carbon production and lifestyle, organic agricultural production and consumption will be put on the government's agenda as soon as possible, and a clean and low-carbon lifestyle will rapidly change the traditional habits and practices of the Chinese people. It can be said that both the Chinese government's proposal to reach carbon peak by 2030 and carbon neutrality by 2060 will point out a clear strategic direction for China's green and low-carbon production and lifestyle. It can be expected that in the next 5-10 years, China's organic agricultural products and food processing will take an unprecedented leap forward.

Secondly, with the Chinese people's pursuit of health and understanding of wellness, organic agricultural products and processed foods are increasingly favoured by consumers in the Chinese market.In recent years, these products have moved from high-grade consumers to the tables of ordinary people, in fact, the price of these organic agricultural products is not higher than the price, such as the Beijing market, a catty of organic spinach is just 5.3 yuan, while the conventional production of spinach has also reached 2.5 yuan. According to the International Organic Federation, by the end of 2019, China has 13813 producers who have obtained 21,746 certificates of China's organic standard, up 12.3 per cent year-on-year. There are currently about 1.6 million producers of organic vegetables, fruits, nuts, feed, oilseeds, and grains in China, totalling more than 2 million when farming and related processors are added. China's organic processing enterprises have reached 5,120 as of 2019, mainly in Northeast and North China. 5,506,400 tonnes of organic products were processed in 2019. What is more obvious is that with the increasing demand for organic products in the Chinese market, more and more multinational companies and foreign enterprises are not only exporting organic food to China, but also actively building factories and investing in China. By 2019, 220 foreign multinational companies have already obtained 440 certificates of China's organic standard. Based on the current development momentum, it can be predicted that this number will continue to double in the next five years.

Third, smart agriculture drives the development of the organic agricultural products industry. At present, smart agriculture shows better development potential in China. The continuous emergence of innovative technologies has fundamentally changed the development mode of traditional agriculture, through the application of Internet of Things (IoT) technology, artificial intelligence (AI) technology, GIS technology, and big data technology, etc., so that China's agriculture has been transformed from the traditional agriculture mode of watching the sky for food to the high-yield, high-efficiency, low-consumption, high-quality, eco-friendly, and safe mode of smart agriculture. With the continuous development of the Internet of Things technology, data storage, comprehensive perception, data on the cloud and other ways to make smart agriculture transmission network to further expand the Internet + smart agriculture model continues to emerge. In the future, smart agriculture will penetrate into all aspects of agriculture, and further promote the development of organic agricultural products industry.

Fourth, the epidemic has also boosted the production, consumption and export of organic agricultural products in ChinaLouise Luttikhot, Executive Director of the International Organic Federation. Louise Luttikhot, Executive Director of the International Organic Federation (IFOAM), said: ‘2020 will be remembered globally for the new Crown Pneumonia epidemic, which has highlighted the fragility of the global food system and the issue of sustainability,’ said Louise Luttikhot, Executive Director of the IFOAM. The 2021 UN Food System Conference is a global call to ‘launch bold and innovative actions’ to change the way the world produces and consumes food.

Future Operation Outlook

Vertical farming for a new future in urban agriculture

Agriculture is a basic industry of the national economy, and its development has a bearing on the food and clothing of more than a billion people, and more directly affects the progress of other industries. Against the backdrop of recurring epidemics, frequent occurrence of extreme weather and soaring fossil energy prices are bringing unprecedented impacts on the global food supply chain, with dramatic fluctuations in food prices and vegetable prices, making people living in cities worry about obtaining a sustainable and stable food supply, and perhaps vertical agriculture, which will be the key to cracking this problem. Vertical agriculture will be a horizontal surface of the planting system, moved indoors and expand vertically, in order to maximise the use of planting space, planted vegetables or food is not grown in the soil, but in the circulation of water, or even contains nutrients, water and oxygen in the mist, in order to achieve ‘the use of less energy, smaller land resources, to produce more food! The goal is to ‘produce more food using less energy and less land. The most important reason for bringing vertical farming to cities is that at the current rate of population growth, the world's population will rise from the current 7 billion to 9 billion by 2050, and at the same time, climate change is likely to reduce crop yields by 25 per cent, and by that time, there will be no fertile land to feed everyone, and humanity will have to face the challenge of producing more food on less land, which provides an opportunity for vertical farming to develop. Opportunity.

Leafy vegetables, for example, take about 30-45 days to produce conventionally; vertical farming takes about 15 days from planting to harvesting, and because of the enclosed environment and the stacking of verticals, you can produce hundreds of times more crops per acre than you would with conventional farming. This is achieved through hydroponics or aeroponics, a method of growing plants indoors, which means that the roots of the plants are in nutrient-rich recycled water, which actually reduces the amount of water used, with one study showing that hydroponics produces 90 per cent fewer vegetables than traditional growing, and aeroponics, which involves spraying a nutrient-rich mist of water over the roots, uses another 70 per cent less water than traditional cultivation. Aeroponics, which involves spraying nutrient-rich water on the roots, uses another 70 per cent less water than hydroponics.

According to statistics, 20 to 40 per cent of crops grown are damaged by pests and diseases, and in a closed environment with no soil, they can be computer-programmed to precisely control every aspect that affects the growth of crops, from temperature, humidity, lighting to nutrients, and they are able to provide the optimum growing conditions for each type of plant. This means that crops grow without the damage of pests and diseases, which means that fungicides and insecticides are not needed for healthier, more nutritious food, and it also means that crops are not affected by climate change or the seasons, and that vegetables are available locally all year round at a consistent price.

Currently, produce is often supplied through inter-regional or even cross-country transport for as little as two or three days, or as long as a week or more, requiring the consumption of more fuel while running the risk of both spoilage and compromising the flavour of the product. With the introduction of vertical farming, it will be possible to focus more on improving quality and transporting food without losing nutritional value, as it will be possible to get vegetables from the production site to the table in a matter of hours.

Science and technology empowerment, data accumulation to create future sustainable development power

China's ageing is exacerbating the lack of labour, urbanization is accelerating and crowding out arable land, and land pollution is serious, resulting in an increase in the number of challenges faced by traditional agriculture, and our country must change the inefficient and high-consumption mode of operation of agriculture and take the route of technology as a substitute for resources, so that scientific and technological innovations to improve food yields and food security have become the key to solving the problem of food shortages, and to satisfy the people's demand for food by increasing production and efficiency.

Vertical Farming (VF), as a new agricultural model, has the advantages of improving water and fertiliser utilisation, reducing the cost of transporting agricultural products, and flexibly coping with adverse weather. Therefore, data-driven crop growth of vertical farms has become the key to promote China's agricultural modernisation process and ensure China's food security. It distinguishes itself from traditional outdoor farming by growing vegetables indoors. Characterised by itsA three-dimensional growing method whereby multiple growing layers are stacked vertically together to form a growing support. Light is provided by other light sources such as LEDs, and nutrient solution is drip irrigated by water mist or automatic drip irrigation systems, enabling continuous crop production throughout the year through high-precision environmental control. The main advantages of vertical farming over traditional forms of agriculture are.Annual production, not affected by climate, region, season; site selection freedom, can be three-dimensional planting on limited land; a great degree of water conservation, avoiding the problem of evaporation of traditional irrigation water, recycling efficiencyThe main disadvantages are. The main disadvantages are: the initial equipment costs and energy costs of vertical agriculture are high; its operation requires professionals to fine-tune the operation and commissioning.

Vertical agriculture in addition to full of ‘futuristic’ appearance, its internal system mainly consists of the following different hardware equipment and software equipment, hardware is from the integration, software is usually self-research, technology content is higher. Hardware equipment includes smart cabinets, sensors, LED lights, etc., while software equipment includes automated control systems, backend data systems, and so on. Breeding data, plant growth algorithms, light control and other data will be a company's valuable intangible assets, and the secondary use of crop models is an extension of vertical agriculture in the future development direction. Through continuous observation of product growth data, environmental data and other continuous optimisation and iteration, in order to achieve the best growth conditions of vegetables.

Green consumption, leading the market into a new phase

Vertical farms are an industry with high fixed cost inputs and barriers to entry. From the perspective of fixed cost inputs, the construction cost of a single farm can reach hundreds of millions of dollars, with lighting costs accounting for about 30 per cent of the operating costs of vertical farms. From a technical point of view, vertical farms are different from traditional agricultural farming, relying more on technical support and talent pool.Vertical farms around the world originated in 1970 and are currently in a stage of rapid development, while China's vertical farms started late and are still in a stage of development, and have not yet run out of the beginning of the scale of the enterprise.Therefore, the track still belongs to the blue ocean market, the development space is large, but the threshold of entry is relatively high, requiring companies to have capital, technology, talent and other composite capabilities.

With the significant increase in the national economy and per capita income level, the concept of Chinese consumers has changed, and more people have begun to pay attention to food safety and food quality, the pursuit of pollution-free, green and organic agricultural products. Middle and high-end consumer groups such as white-collar workers and the middle class have an increasing demand for green agricultural products, as well as increased attention to product quality, health and nutrition. Currently, the awareness rate of green food logo among consumers in China's first, second and third-tier cities has reached 73.5%. Chinese consumers' demand for green food will lay a good market foundation for the rapid development of vertical farms, and will also force more traditional farms to transform into vertical farms, bringing new incremental development for related enterprises.

According to GlobeNewsWire, the vertical farm market in China will reach RMB 4.26 billion in 2020 and is expected to grow to RMB 12.84 billion by 2026, at a CAGR of 24.6%. The significant growth in China's market size is mainly attributed to the rising consumer demand for safe and high-quality green food, advancement in several technologies in vertical farms, and increasing food safety awareness. In addition, the growth of the vertical farm market in China will be further impacted by increasing urbanisation and shrinking arable land.

Article by Jiao Shuang, Feng Yinying, Chen Han

Affiliation: School of Economics and Management, Dalian University of Technology

Article Editor: Tansensor